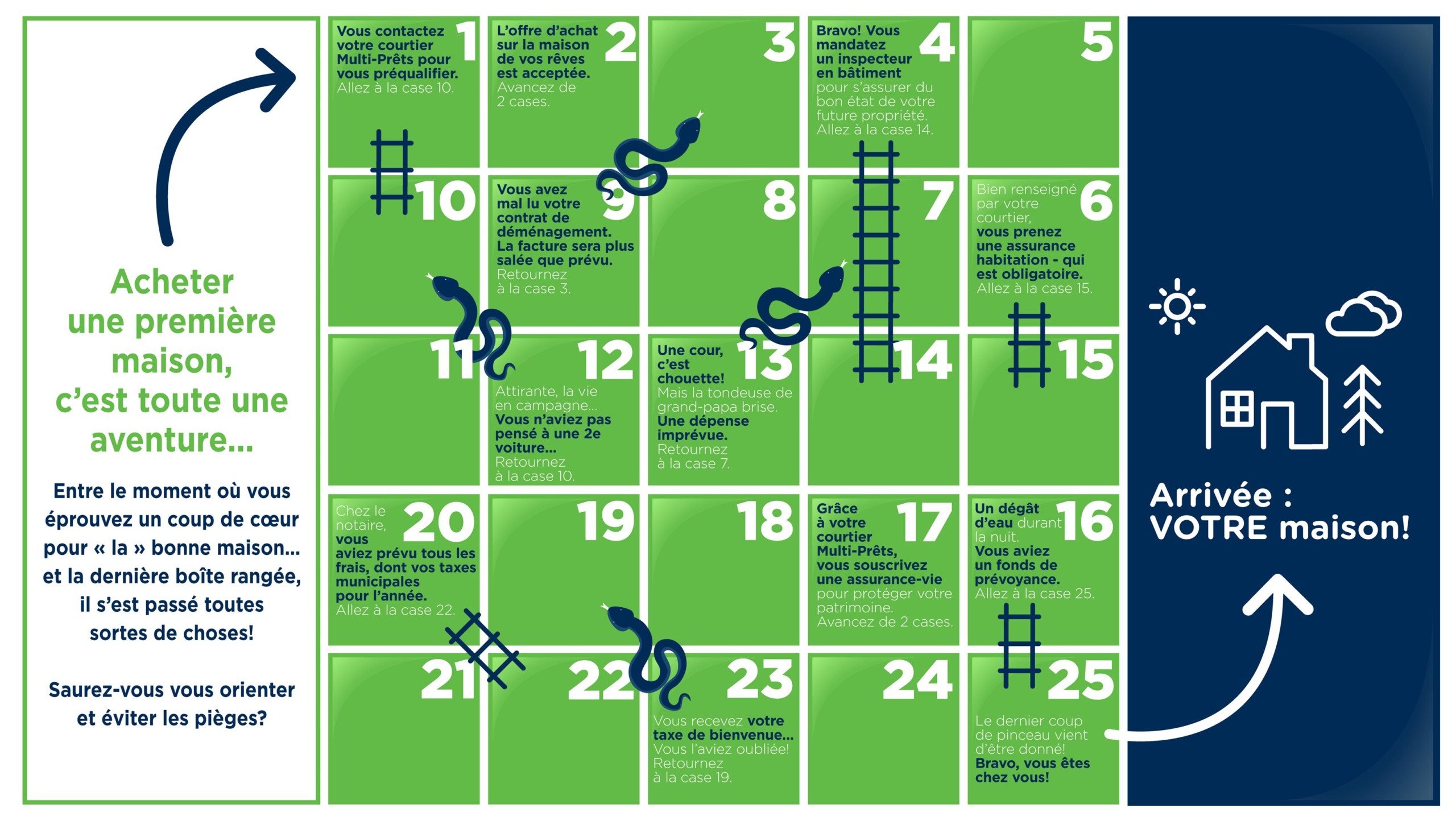

Buying a house or condo includes many additional expenses that you don’t have to deal with when renting. To help you make more informed decisions when it comes to house hunting, we’ve come up with a handy list of common, and not so common expenses buyers should anticipate before signing on the dotted line.

No surprise, the list includes the obvious expenses that most buyers (first-time o seasoned), are aware of. We have also included some hidden gems that we bet you’ve never considered when thinking about homeownership. So, let’s get started! And be sure to take notes!

Costs incurred to complete a purchase

During the home buying journey, you’ll meet plenty of folks (agents, inspectors, notaries, et cetera) that will help guide you along the way. Unlike the professionals mentioned above, the expert services of your mortgage broker will cost you nothing. Here’s an important cast of characters you are sure to cross paths with when buying a home:

- A building inspector. Using their expertise is a great way to reassure that you are making the right decision to buy. An inspector can also advise you on what needs to be fixed, provide a timeline for recommended repairs, and an approximation of the costs associated with the work. And though their advice comes with a cost, it can be priceless when deciding to buy or not to buy!

- In addition to your interest rate, signing a mortgage comes with other fees that you’ll need to be aware of. And don’t forget mortgage insurance (if your down payment is less than 20%), and mortgage life insurance, if necessary.

- You’ll also need homeowner or condo insurance, which in the majority of cases is more expensive than tenants insurance because the risk and home expenses are no longer shared with the owner. You will now be the sole owner! Take a minute to learn more about the exclusive insurance offers available to our clients. Contact us!

- Notary fees to confirm the deed of purchase and the mortgage deed. The notary will also manage the transfer of funds between the buyer and seller. There also may be fees related to the closing of an existing mortgage if it’s still registered.

Moving and living expenses

Now that the transaction is concluded and the house is officially yours, here’s a handy list of other common expenses you can anticipate:

- Movers! If you don’t have a fleet of SUVs and 10 bodybuilder brothers to help you out, a moving company will save you time, headaches, and more importantly, a trip to your osteopath or chiropractor. That said, when hiring a mover be sure to check whether your contract is based on an hourly fee, flat rate, and states how many employees will be working during the move. And always get an estimate based on your belongings in advance of the big day.

- Cleaning costs for carpets, bathrooms, wood floors, windows, ventilation ducts, as well as a few gallons of paint to make the home… your home!

- For security and peace of mind, you’ll need new locks, and may want to consider installing an alarm system as well.

The element of “surprise” fees!

It’s been a few weeks, or maybe a month since you’ve moved into your new home, when (to your surprise) that special envelope arrives in the mail. Yes sir, say hello to the homebuyers’ BFF… the dreaded tax man! Municipal and school taxes are a necessary evil for any homeowner. They can vary widely from house to house, neighborhood to neighborhood, and can occasionally turn off prospective buyers when it comes time to sell. So don’t hesitate to ask your municipality for a summary on the anticipated taxes in advance. The information is usually available online for free.

Of course, the cost that most buyers forget about (or choose not to remember) after settling into the friendly confines of their new digs is the infamous “welcome tax”, or commonly referred to as the “land transfer tax”. This is a mandatory fee, that as a buyer you must pay to the municipality each time you purchase a property. The amount varies according to the value of the property in question.

Finally, owning a home is synonymous with increased responsibilities. Put simply, you’ll no longer be able to call the owner or building administrator to turn up the heat, replace the hot water tank, a leaky faucet or faulty air conditioner. You are the owner now! To avoid the stress, annoyance and worry of being able to cover unexpected expenses, we recommend that you set up a contingency fund. The fund will cover any emergency repair work that may occur especially over the long cold days of winter. Taking out a home equity line of credit could also be a great way to cover any unexpected costs if ever trouble arises.

Key takeaways

- Words of wisdom to all house hunters… buyer beware! Specifically, be aware of the additional costs before you buy, when you buy, and long after you’ve moved in.

- The building inspector, the notary, the real estate agent, and finally your mortgage broker can all help ensure clear sailing on your homeownership journey.

- Experts recommend that you have a contingency fund readily accessible or a home equity line of credit to deal with unexpected surprises and expenses.

- Annual property and school taxes and one-time welcome tax are non-negligible costs, and should always be taken into account when deciding to buy or not to buy a property.