Buying your first home can certainly be an adventure, so it’s important to use all the relevant information available to help ensure a smooth ride during your homeownership journey. Let’s see what you already know, and more importantly, what you can learn about the popular Home Buyers’ Plan (HBP) program.

The 101s of the HBP

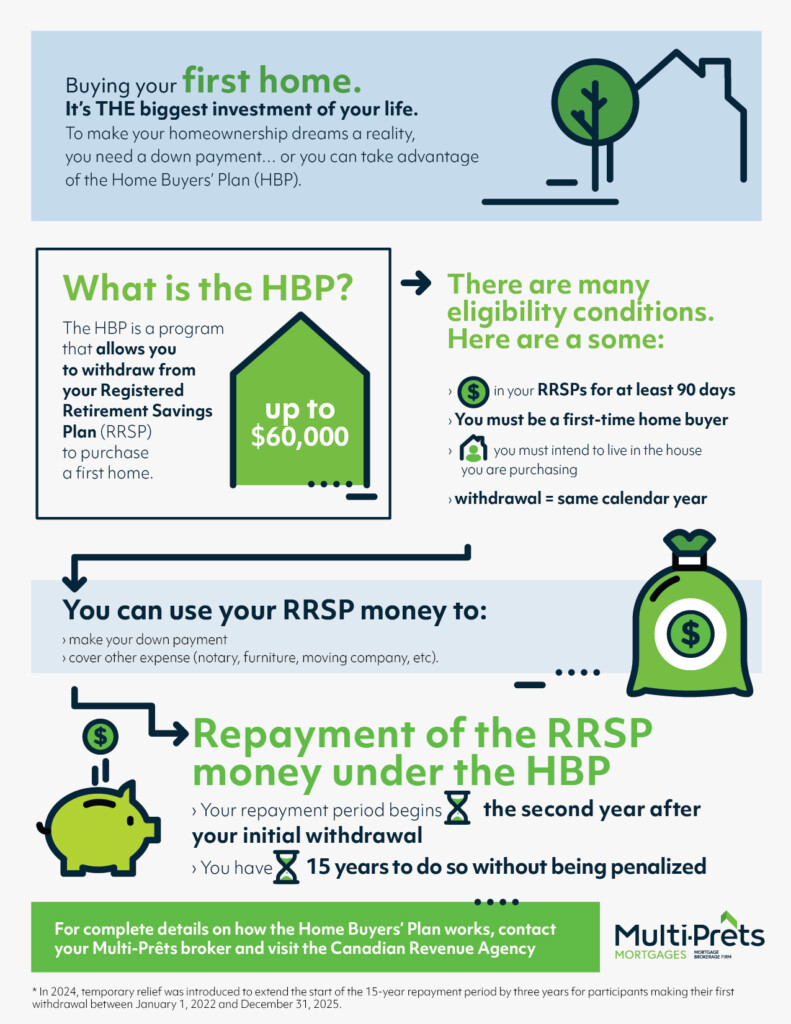

According to the Canada Revenue Agency (CRA): The Home Buyers’ Plan (HBP) is a program that allows you to withdraw up to $60,000 (applicable to withdrawals made after April 16, 2024) in a calendar year from your registered retirement savings plans (RRSPs) to purchase or build a qualifying home.

Since 2020, following the dissolution of a marriage or de facto union, divorced or separated persons are also eligible to participate in the HBP, even if they do not meet the first-time homebuyer requirement.

In a nutshell, you’ve been putting money aside for a while in an investment fund linked to an RRSP account that has hopefully grown over time. Thanks to the HBP program you can now withdraw a portion of it, with no penalty, to use as a down payment (or any other expenses related to the purchase of a home or condominium). Remember, your down payment must be at least 5% of the total value of the property.

Eligibility conditions under the HBP

No surprise the HBP program includes that certain terms and conditions are met. Here are the main ones regarding eligibility. First, you must intend to live in the house you are purchasing through the HBP program. Also, you may still qualify as a first-time buyer and be eligible for the program, even if the dwelling is not your first home. You must also comply with the terms and conditions of the four-year period, as explained on the Canadian Revenue Agency CRA website: You are considered to be a first-time buyer if, during the four-year period you did not live in a dwelling owned by you or your spouse or common-law partner.

You must also satisfy the conditions for an RRSP withdrawal and not exceed an amount of $60,000.

Do you have to repay the RRSP money under the HBP?

Yes. The gist of the program is that it actually allows you to “lend money” to yourself and deposit the funds into an RRSP for the next 15 years without interest. As such, your repayment period begins the second year after your initial withdrawal. In 2024, temporary relief was introduced to extend the start of the 15-year repayment period by three years for participants making their first withdrawal between January 1, 2022 and December 31, 2025.

You can also repay the RRSP money at any time, but it’s usually on your annual tax return that you’ll “refund” the RRSP money. Simply notify your accountant and they will arrange that your repayment complies with the applicable laws.

Obviously, this section does not include all the intricacies of a transaction under the HBP program. For more details regarding the program, consult your Multi-Prêts mortgage broker!

For more information, visit Canada Revenue Agency website.

Key takeaways

- You can “borrow” up to a maximum of $60,000 under the HBP program.

- The repayment period under the HBP program is 15 years.