You wish to buy a house, but you are wondering how to save the thousand dollars you need for a down payment?

At first sight, we know it doesn’t seem easy. However, when you analyze the situation, workable solutions appear. Here’s some advice!

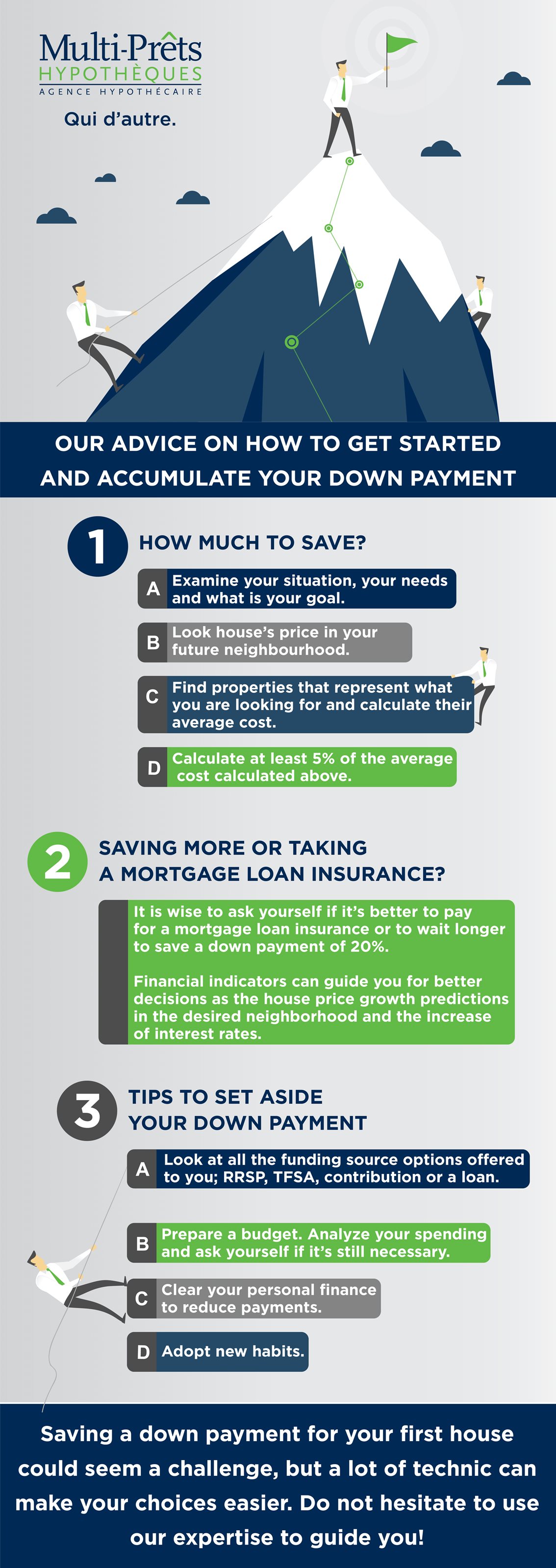

How much to save?

First of all, you must examine your situation, your needs and what is your goal. Focusing on what is engaging makes it easier to save, especially when you have a sum to reach instead of money ‘’for later ‘.

Look house’s price in your future neighbourhood to get an idea of the sum to reach. Find properties that represent what you are looking for (lot size, number of rooms, proximity of schools and public transportation, etc.) and calculate the average. If the average is $320,000 and you wish to save 5% of this amount, you must save $16,000.

The sum of your down payment influences your mortgage in two different ways:

- Higher your down payment is, less your loan will be. Your down payment reduces your payments.

- The rate you paid has an impact on your charges: if your down payment is less than 20%, you must contract a mortgage loan insurance.

You must add to your budget charges related to your purchase as transfer tax, notary fees and ongoing expenses.

Saving more or taking a mortgage loan insurance?

You can purchase a house with only a down payment of 5%*. It is wise to ask yourself if it’s better to pay for a mortgage loan insurance or to wait longer to save a down payment of 20%. To better understand the process, your Multi-Prêts mortgage broker will help you calculating.

You must consider important things: the house price growth predictions in the desired neighborhood and the increase of interest rates. If no change has occurred lately in this area, it is OK to wait. However, cities or districts have significant increase in the value of its properties.

Obviously, no one can predict the future, and financial indicators can guide you for better decisions. Numbers are significant, and before taking an important decision, do not only consider the sum to pay. Quality of life that brings a house is incomparable!

Tips to set aside your down payment

Before tighten your belt, look at all the funding source options offered to you. For example, your RRSP and your TFSA can be your down payment. You can also complete your down payment with a contribution or a loan. Once you established the sum to save, follow these steps:

- Prepare a budget: analyze your spending and ask yourself if it’s still necessary. If you buy a $3 coffee every day, it’s $720 per year! Of course, coffee won’t completely change your down payment. Depending on the lifestyle you wish, the key answer is to determine which part of your income you could concede to your mortgage payments.

- Managing your debt: Clear your personal finance to reduce payments. Restrict number of creditors will help you to see clearly and make good decisions in the near future.

- Adopting new habits: Do you really need a subscription of $45 a month to the gym? Could you use public transportation? Go on a cheaper journey? Make a list of realistic changes you could plan in your life. Drastic cuts would affect enjoyable living in your new home.

Easier than you think!

Saving a down payment for your first house could seem a challenge, but a lot of technic can make your choices easier. Never forget that you can get a property with a down payment of 5%.

Do not hesitate to use our expertise to guide you!

* for properties that costs less than $500,000.

Key takeaways

- Set your goal at the beginning

- Acquire good financial habits and prepare a budget.